The smart Trick of Chapter 13 Discharge Papers That Nobody is Discussing

Some Ideas on Copy Of Chapter 7 Discharge Papers You Need To Know

Table of ContentsHow To Obtain Bankruptcy Discharge Letter Things To Know Before You Buy9 Simple Techniques For Chapter 13 Discharge PapersThe Best Guide To Copy Of Chapter 7 Discharge PapersSome Known Questions About Bankruptcy Discharge Paperwork.Facts About Copy Of Bankruptcy Discharge Revealed

Attorney's are not called for to maintain personal bankruptcy filings."Free Bankruptcy Papers"A. All Company as well as Organization Files, might be purchased by calling the United stateA. Bankruptcy records personal bankruptcy documents utilize kept indefinitely until Forever. Laws have actually currently transformed to maintain insolvency documents for just 20 years - https://myanimelist.net/profile/b4nkrvptcydcp.

If you submitted personal bankruptcy in 2004 or prior, your documents are restricted, and might not be offered to purchase online. Phone Call (800) 988-2448 to check the schedule before purchasing your documents, if this puts on you. The documents may be available through NARA.(a government firm) We do not work in conjunction with NARA or any of its reps.

What Does Chapter 13 Discharge Papers Mean?

United state Records cost's to help in the retrieval process of obtaining insolvency documents from NARA, depends on the time involved and also expense included for U.S. Records, plus NARA's costs The Docket is a register of general info during the personal bankruptcy. Such as condition, case number, declaring and discharges dates, Lawyer & Trustee info.

If you're late paying the tax obligation, keep the return two years from the date you paid or three from when you submitted (whichever is later). When it concerns receipts, if there's a service warranty, keep the receipt up until the guarantee runs out. Otherwise, for anything you could need to reclaim, just maintain the receipt up until the return duration is up.

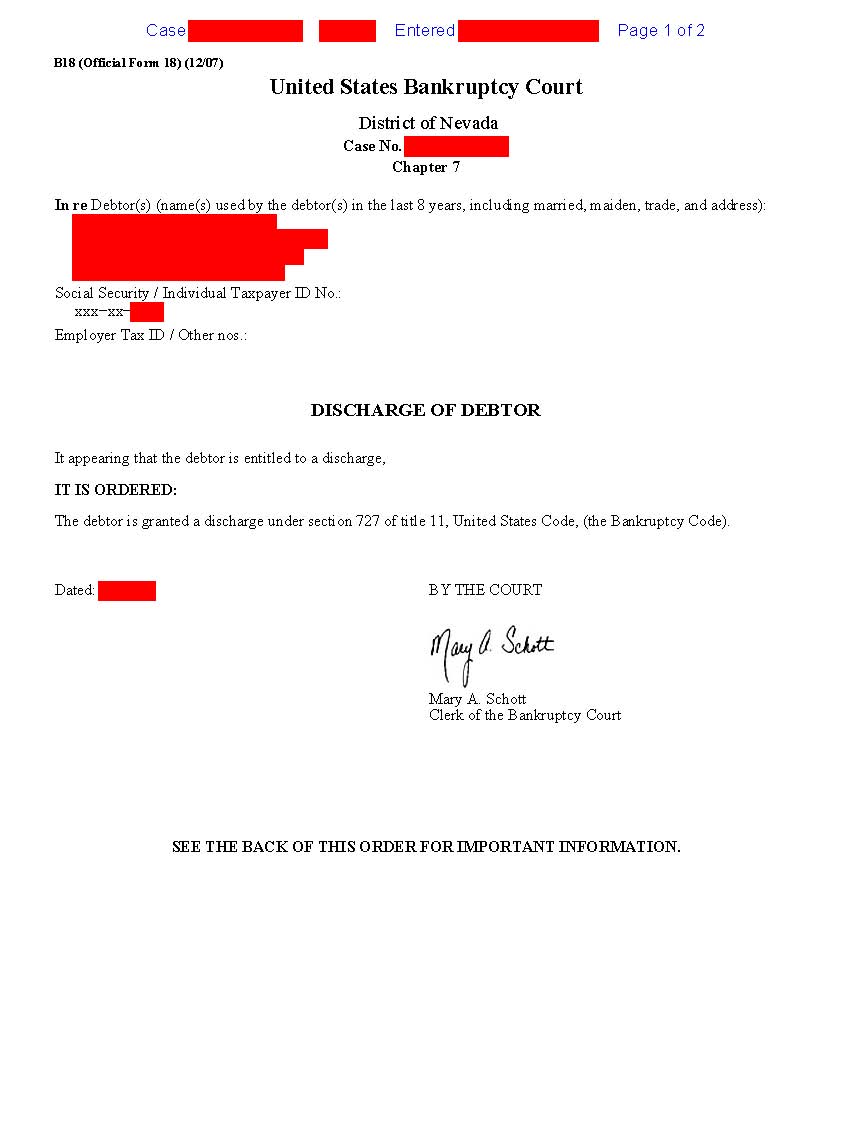

Although your personal bankruptcy petition, documents, and also discharge appear like economic records that can drop under the very same timeline as your tax obligation docs, they are NOT (chapter 13 discharge papers). They are much more vital and need to be kept forever. Lenders may come back and try to gather on a financial obligation that belonged to the insolvency.

How Copy Of Bankruptcy Discharge can Save You Time, Stress, and Money.

Additionally, lenders liquidate uncollectable bill in pieces of thousands (or hundreds of thousands) of accounts. Negative debt buyers are often aggressive and also deceitful, as well as having your insolvency documents on-hand can be the fastest way to shut them down as well as maintain old items from standing out back up on your credit scores record.

Getting copies of your insolvency files from your attorney can take time, specifically if your case is older as well as the copies are archived off-site. Obtaining bankruptcy records from the Federal courts can be expensive and also lengthy.

Obtain a box or large envelope as well as placed them all inside. Place them in a safe location, also like where you keep your will certainly and other crucial financial papers as well as simply leave them there.

10 Simple Techniques For Copy Of Bankruptcy Discharge

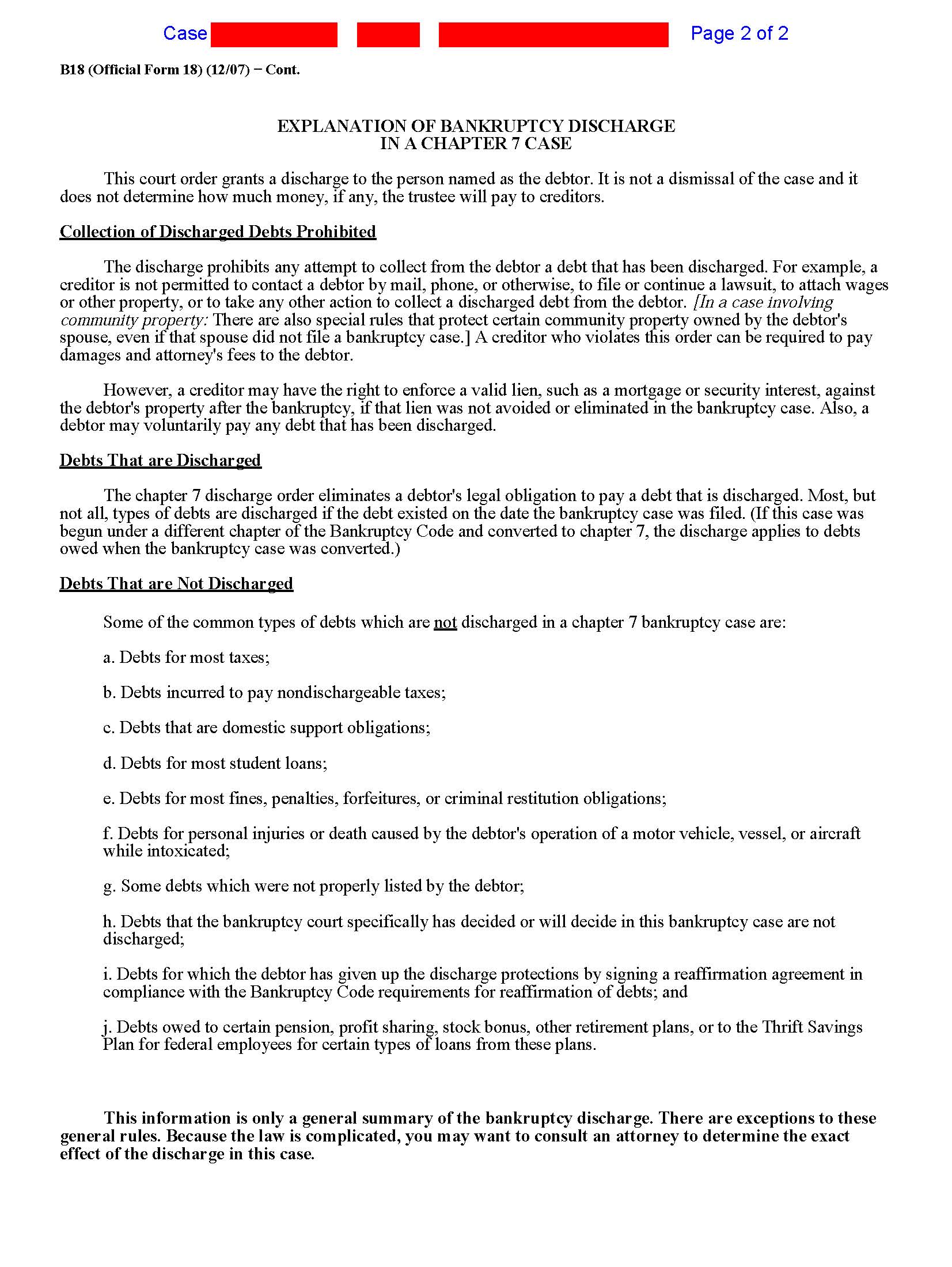

A released financial obligation literally goes away. Financial debts that are likely to be released in a personal bankruptcy case include credit card financial debts, medical expenses, some lawsuit judgments, personal finances, commitments under a lease or other agreement, and also other unprotected financial obligations.

You can't simply ask the personal bankruptcy court to discharge your financial obligations because you do not want to pay them. You need to finish all of the needs for your insolvency instance to receive a discharge.

Insolvency Trustee, as well as the trustee's lawyer. The trustee personally handles your insolvency instance. This order includes notice that lenders need to take no additional actions to collect on the debts, or they'll deal with penalty for contempt. Keep a duplicate of your order of discharge in addition to all your various other insolvency documentation.

The Single Strategy To Use For Copy Of Chapter 7 Discharge Papers

You can submit a movement Full Report with the personal bankruptcy court to have your case resumed if any lender tries to accumulate a released financial debt from you. The creditor can be fined if the court figures out that it breached the discharge injunction. You can attempt just sending a copy of your order of discharge to stop any kind of collection task, and afterwards talk with an insolvency lawyer about taking lawsuit if that doesn't work.

The trustee will liquidate your nonexempt possessions and divide the earnings amongst your financial institutions in a Chapter 7 bankruptcy. Any type of debt that stays will be discharged or gotten rid of. You'll participate in a repayment strategy over 3 to 5 years that pays off all or a lot of your financial debts if you apply for Phase 13 protection.